CE-Hub, 2024

Case study: Ricoh

2022, CE-Hub Team

Sector Focus: Technological solutions

Approach, activities & rationale:

The shift from linear ‘take-make-waste’ to more circular business models can be a challenge for incumbent operators, but equally is becoming increasingly critical on commercial as well as environmental grounds due to two key factors. Most notably, as the cost of raw materials increase, securing resource for manufacturing and production will become more challenging. Strong global demand (especially from China), the rise in oil prices and a shortage of global shipping capacity are noted to have put additional pressure on supply chains since the global pandemic. Secondly, both with concerns of wider brand reputation as well as changing legislation around Extended Producer Responsibility (ERP), companies are needing to be more attentive to the full lifecycle of products they produce.

Having grown over the last decade, the model of ‘selling a printed page’ now represents around 50% of UK office automation revenue. The two key attributes of this model are the long-term funding requirements of the model and the resource-heavy nature of maintaining and recovering assets at end of use. However, these are balanced by the benefit of maintaining control of the hardware, consumables and parts throughout their entire lifecycle. This final point is key given the company has a policy of zero-waste to landfill, which can be challenged by the linear sales model given control of the assets is transferred to the customer, with no specified end-of-life plan.

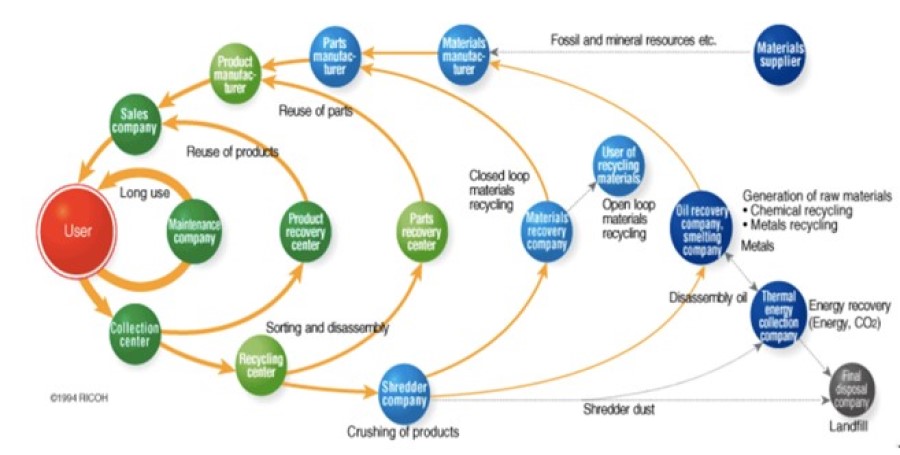

To focus attention on the cycles of products, Ricoh – the world’s leading manufacturer of office automation equipment, such as photocopiers and printers – developed the Comet Circle almost thirty years ago, detailing company activity in product lifecycles and that of third parties. Despite its age, this model bears many similarities to the material loops seen in more recently depicted framework of a circular economy. While this provides a broad theory, as a global company with geographically dispersed assets, there is a resource implication of moving product around the globe which requires careful management. As such, sitting behind the Comet Circle is the Ricoh Asset Cascade, supported itself by a proficient Enterprise Resource Planning (ERP) tool. The Asset Cascade aids the commercial judgement of teams on the ground to determine the most viable route for appropriate ‘feedstock’, in the form of hardware, consumables and parts, returning to the Ricoh system. Essential to viability of the lease model proposition and ‘selling a printed page’, every component is monitored with tracking and use-meters providing appropriate granularity of detail to accurately assess the retained value in individual parts.

Looking to the future, legislation may steer a change to Ricoh’s primary logic and force an update to their business model, away from a requirement of economic viability. The EU have recently published guidance for Public Procurement for a Circular Economy, encouraging the application of circularity within tenders for government procurement. While this is optional at the moment, within the sphere of office automation, Italy have already applied a requirement of 30% circularity to all consumables whilst other EU nations are looking to implement the code in 2022, with an as yet unknown percentage potentially against hardware as well as consumables. With such moves, the continuity of circular practices may become a requirement in order to tender for lucrative government contracts, even at a financial cost, which gives rise the question of who will bear that cost.

Leadership:

Established in 1934, the global company Ricoh is the world’s leading manufacturer of office automation equipment, such as photocopiers and printers. As a thought-provoking case study demonstrating the realities of making such a shift, Ricoh has developed two business models, building a remanufacturing operation alongside the traditional sales route. This process has required a significant investment in systems and processes to ensure both operational efficiency and financial viability. Worth noting also that while the remanufacturing business model demonstrates an effective circular business model, it is assessed by Ricoh primarily on an economical basis.

Challenges & enabling change:

Economics and finance, Operations and Structure

A key tension in Ricoh’s Asset Cascade system is the company-enforced parameter of economic viability; unless the finances add up the activity is unlikely to be continued. Taking one example of a consumable toner bottle, a reused bottle can ordinarily offer an 8% cost saving over a virgin bottle, which is significant when considering that Ricoh fills many hundreds of thousands of toner bottles every month. However, the recovery cost of the reuse bottle constitutes over 60% of the cost so a change in transport costs, as is a reality post-pandemic, can quickly cause this to become an economically unviable operation. Following company protocol, this activity would then be challenged from a viability perspective, which in itself brings challenges over logistics and operations, in addition to conflicting with social and environmental messages as well. Recovery channels are hard to turn off once set up, demonstrating the finely balanced economic model sitting against a business trying to be environmentally sound.

Regulation and policy

Looking to the future, legislation may steer a change to Ricoh’s primary logic and force an update to their business model, away from a requirement of economic viability. The EU have recently published guidance for Public Procurement for a Circular Economy, encouraging the application of circularity within tenders for government procurement. While this is optional at the moment, within the sphere of office automation, Italy have already applied a requirement of 30% circularity to all consumables whilst other EU nations are looking to implement the code in 2022, with an as yet unknown percentage potentially against hardware as well as consumables. With such moves, the continuity of circular practices may become a requirement in order to tender for lucrative government contracts, even at a financial cost, which gives rise the question of who will bear that cost.

On reflection:

Fundamentally, Ricoh is operating in a market which is both saturated and shrinking. Printing volumes, particularly post pandemic, continue to reduce. One argument would suggest that their remanufacturing operation does not signify true circular business transformation. However, as the core of the Ricoh operation, it is fundamental in order to maintain commercial viability in the short term and provide opportunity for a broader company transition.

Cannibalisation is also a genuine issue with this model which Ricoh monitor carefully. Given the high fixed asset costs associated with production of new products, the volume of remanufacturing is actively adjusted so as not to impact essential production volumes. In this sense, remanufacturing remains a secondary operation of the business, which when combined with the economic parameter, perhaps leaves this Ricoh operation more in the sphere of resource efficiency than true circularity.

Further information / Learn more:

Adapted from the Vignette authored by Georgie Hopkins.