2022, CE-Hub Team

Case study: Circularity Capital

2022, CE-Hub Team

Sector Focus: Finance

Approach, activities & rationale:

Acknowledging that traditional linear growth is now being constrained by a series of environmental ‘mega-trends’, Circularity Capital is a circularity-focused, private equity firm which highlights how businesses are now confronted with the need to decouple economic prosperity from resource use. Founding partner Ian Nolan argues that ‘We are all increasingly realising that much of today’s economic activity produces negative externalities, contributing to climate change, loss of biodiversity and general diminution of the natural capital endowment that our generation collectively inherited from our parents, and which we in turn will pass on to our children’s generation’. On the other hand, businesses may be constrained by barriers such as a lack of expertise or the funds required to transition towards the circular economy.

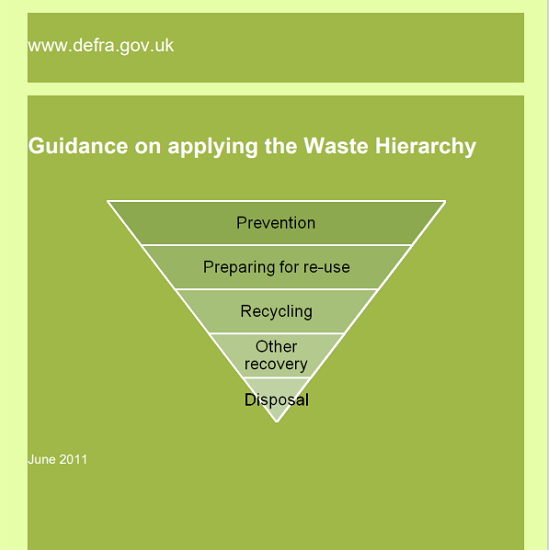

Circularity Capital aims to invest in innovative SMEs which specialise within a range of five clearly defined circular models. Firstly, Circularity Capital seeks to invest in businesses which operate ‘product-to-product’ models, extending asset life or ensuring multiple use cycles through maintenance and refurbishment. Secondly, Circularity Capital also invests in businesses which operate a ‘Product as a Service’ model which may benefit access to goods or services as opposed to ownership. Thirdly, Circularity Capital seeks to promote ‘product from waste models’ in order to maintain material flows from waste into high-value products, whilst ‘circular design’ models ideally see businesses optimising the design of products or materials towards the possibility of recycling, reuse or biological restoration. Finally, the ‘enabling solutions’ model envisions businesses using available resources such as data to extend asset life, increase usage cycles, and reduce waste and emissions within their output. Businesses which have secured Circularity Capital’s support by following such business models have prospered. For example, Grover is a company within Circularity Capital’s portfolio which recently secured a further $1 billion in equity and asset backed financing in order to grow its ‘Product as a Service’ offering, whilst another business within the portfolio which provides a ‘Software as a Service’, omnichannel offering to maintain the circularity of returned clothing was sold in March 2021 for $70 million to another established business within the retail industry. The large sums secured within such investments or sales demonstrates how Circularity Capital’s support can facilitate not only the growth of circular businesses themselves, but also allow them to drive industry-wide shifts towards the circular economy.

The approach adopted by Circularity Capital rests upon four ‘pillars of support’, which are reflective of the leadership team’s expertise.

Firstly, Circularity Capital seeks to deploy strategic support and guidance to help businesses deliver their future plans. Secondly, Circularity Capital provides specialist operational support to allow its portfolio members to access suitable operational partners and to allow collaboration in order to fill in capability gaps. This then feeds into the third principle of capability building, allowing access to the world’s leading expertise to drive innovation and value. This principle is perhaps the most important of all, allowing investee businesses to access expertise to facilitate training and circular jobs. Finally, Circularity Capital acts as an intermediary, allowing businesses to connect with future customers and partners, as well as the potential to bid for further investments.

Leadership:

The previous background of its founding members means that the leadership of Circularity Capital combines experience from both the finance industry and the circular economy. Three of the four founding partners – Ian Nolan, David Mowat, and Andrew Shannon – have amassed a combined total of over 60 years’ experience in private equity and investment management. The fourth founding member – Jamie Butterworth – is the former CEO of the Ellen MacArthur Foundation as well as previously developing the Circular Economy 100, an innovation programme established to enable organisations to move towards the circular economy.

Circularity Capital highlights the potential afforded by this combined expertise to SMEs which may be considering a transition to the circular economy, with the combination of finance and circularity acting ‘at the heart’ of its operations. The leadership team uses the circular economy as a framework to support transition to circularity, whilst adopting an outward-facing approach in identifying investment opportunities within business models which demonstrate an aim to contribute quantifiable, positive societal and environmental impacts.

Challenges & enabling change:

Regulation and policy

Uncertainty does however exist within the circular financial market and as such, Circularity Capital requires businesses to offer a number ‘key fundamentals’ before providing investment and support. Circularity Capital requires prospective businesses to demonstrate a clear circular economic value creation potential, coupled with strong committed management hence demonstrating a clear vision for future, circular growth. Prospective businesses should also be operating in sectors with growth, as well as demonstrating a proven revenue model. These should then be evidenced within well-defined, executable future strategies. Investments into prospective businesses are also measured against specifically defined environmental, social and governance (ESG) factors which guides Circularity Capital through investment and post-investment activities. The potential and ongoing progress of businesses’ movement towards the circular economy are measured against a set of externally-advised, ESG-based metrics, whilst post-investment activities include an annual review of an ESG scorecard system as well as the provision of continuous support.

On reflection:

Circularity Capital is at the forefront of investment within the field of circular economy, providing businesses with the opportunity to grow providing that they can prove their potential to demonstrate real societal and environmental benefits. However, challenges yet may exist when analysing how Circularity Capital’s model can be replicated. Banks and other lenders would have to change business models when adapting to models such as ‘Product as a Service’, with customers making a series of payments over the lifetime of a product as opposed to making an upfront purchase. Indeed, some business models may appear to demonstrate more potential than others. Whilst models which facilitate the benefits of data in designing out waste would interest the wider retail and hospitality sectors, those based on access over ownership through the denial of the opportunity to sell or reuse a given product at the end of the product’s usage cycle. Nonetheless, such perceptions could be addressed through the wider education which Stahel argues should occur to promote the growth of circular economy.

Further information / Learn more:

https://circularitycapital.com/our-approach

Adapted from Vignette authored by Jamie Wheaton.