CE-Hub Digital Series: Extending the Life of Consumer Electronics

CE-Hub, 2023

Extending the Life of Consumer Electronics

As part of the UKRI NICER programme to deliver research, innovation, and the evidence base needed to move towards a more resilient UK circular economy, this series of articles examines the potential benefits of lifespan extension across different product groups and explores the technological, economic, social and policy changes which can help realise these benefits here in the UK. Read the series introduction here.

Key Messages:

- Extending the lifespan of consumer electronics can be an effective way to reduce their lifecycle environmental impacts.

- Following our series overview, we provide estimates of the benefits of extending the lifespans of three widely used consumer electronics – smartphones, laptops and tablets – here in the UK.

- Changes in product design and business models, reverse network management and system enablers such as skills can contribute. Policymakers have a critical role to play.

Stock take

The rise of digital technologies in the 3rd Industrial Revolution and their application in areas including artificial intelligence and robotics as part of the 4th, has seen electronics and an adequate supply of digital information become increasingly critical to the workings of many parts of the UK economy, society and regulation today. Initial estimates for the size of the UK’s digital economy (including the value of digital products and non-digital products ‘significantly affected by digitalisation’) put this at around a quarter of national gross value added (GVA) (ONS, 2022).

Such has been the uptake of electronic and digital products in the UK in everyday life, that today 96% of households in Great Britain have internet access (ONS, 2020), nearly all between the ages of 18 and 64 reported owning at least one mobile phone (ONS, 2020) and approximately two-thirds of adults use an electric toothbrush (Oral Health Foundation, 2020). In 2022, 1.8 million tonnes of electrical and electronic equipment (EEE) were placed on the UK market – a level second only to the year prior (Environment Agency, 2023).

Figure 1. Environment Agency data on electrical and electronic equipment (thousand tonnes)

One consequence of the growing use of electronics in the UK, technological advancement and rapid turnover of devices, has been increasing amounts of electronic waste (e-waste). An estimated 1.6 million tonnes of e-waste or 24kg per person were generated in 2019 – four times the global average (E-Waste Monitor, 2020). Approximately a third of this was lost from the economy to landfill or incineration (Material Focus, 2020), illegal dumping (Defra, 2022; Environment Agency, 2021) and illegal exports (Basel Action Network).

At the same time, one doesn’t have to look far to find examples of activities supporting circular value creation in the electronics sector. 7% of respondents to an Ofcom survey indicated they had acquired their current mobile phone second hand or refurbished (Ofcom, 2023), new business models such as leasing have grown, the turnover and GVA of companies providing electronic and electrical repair services in the UK stood at £6.2Bn and £2.4Bn respectively in 2020 (ONS, 2022) and some companies are shifting towards more sustainable product design (Guardian, 2023).

The opportunity

Electronics contain a range of valuable materials including aluminium, copper and gold, critical raw materials such as cobalt, palladium and rare earth metals, but also hazardous substances such as lead and mercury (Green Alliance, 2011). When electronics move through the economy quickly and aren’t reincorporated at their end of life through reuse, remanufacture or recycling, the value of these materials is lost, waste generated and resource productivity diminished.

Figure 2. Composition of a 2011 Apple Macbook Pro, g (Babbit et al. 2020)

A circular economy is an economic system organised around the principles of designing out waste and pollution, keeping resources in use at their highest value for as long as possible and regenerating natural systems (Ellen Macarthur Foundation). For electronics, this translates into devices being designed efficiently and for longevity, users maintaining and repairing their products and businesses taking goods back at their end of life to refurbish or remanufacture them for sale again.

Extending the life of products can often be the most effective way to reduce their lifecycle environmental impacts (Consumption Research Norway, 2021; Parliament, 2020). This is particularly the case for electronics, lifecycle impacts of which are generally skewed towards extraction and production stages (Prakash et al. 2012; Allwood et al. 2012).

In a study of the carbon footprint of the UK’s e-waste management system, reuse was found to be the most favourable end-of-life option, generating fewer emissions than recycling (Clark, Williams and Turner, 2019). At the same time, improvements in the energy efficiency of new models means this isn’t indefinitely the case for most products and users, and ‘optimal’ replacement moments need to be considered (Hummen and Desing, 2021).1

Longer lasting electronics can bring financial savings to UK households, of particular benefit in periods of economic downturn when the replacement of semi-durables and durables tends to fall. Local government stands to benefit through reduced waste management costs. For businesses, it is more complicated. Longer replacement cycles may represent a loss of sales volume to firms (Cooper 2012) who have increasingly relied on product replacement for revenue (Kantar, 2017). Changes in business models are therefore likely to be needed and a structural shift in the economy towards greater value retention activities (Figure 3).

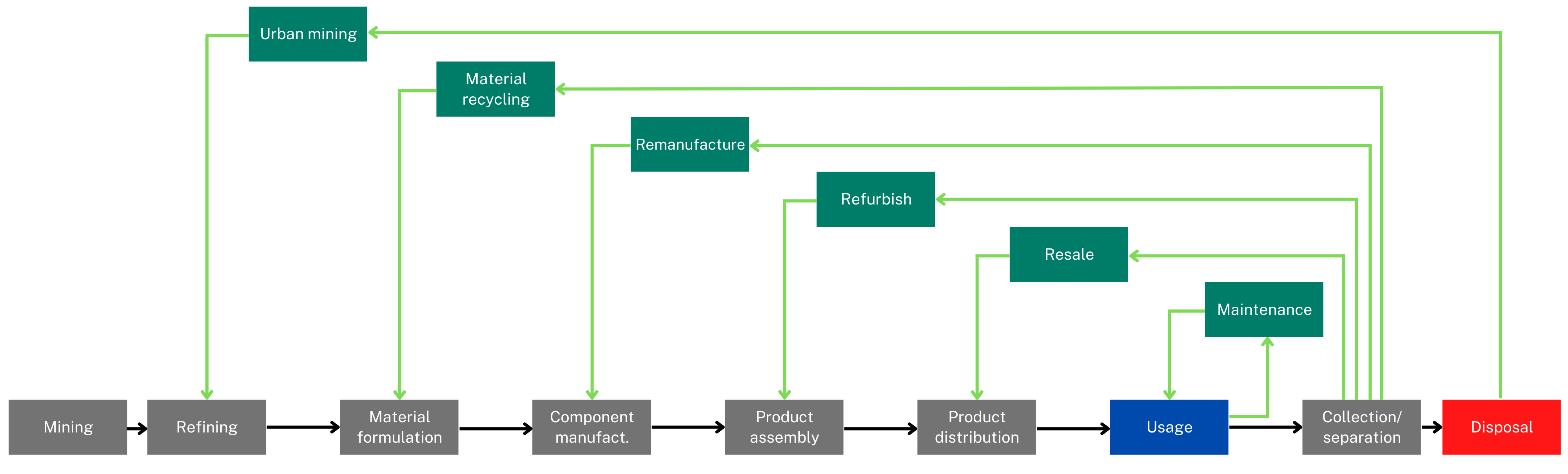

Figure 3. The CE-Hub value chain taxonomy of circular value-retention activities (Zils, 2023)

At the same time, more circular ways of doing things can benefit business bottom lines by helping reduce costs. Materials are a costly input to many businesses in the UK and there is real scope for reducing these to the benefit of resource productivity (ONS, 2022). A survey of 800 organizations by IDC (2016) found annual failure rates of mobile computers to be significant: 18% for notebooks and 16% for tablets. Electronics in use today also represent a future feedstock for a UK electronics manufacturing sector (Make UK, 2020; BEIS, 2022).

Spotlight on smartphones, laptops and tablets

Only commercially available since the 1990s, smartphones have become the most widely used consumer electronic device in the UK today – performing a growing range of functions including camera, mp3 player and mobile banking interface (Bachér et al. 2020). Around 28 million mobile phones were sold in the UK in 2021, with 92% of these smartphones (USwitch, 2022). In the same year, an estimated 10 million laptops were sold and around 5 million tablet computers (ONS, 2022; HMRC, 2023). According to an OECD survey, 93% of UK households now have at least one computer in working condition in their home, up from 30% in 2005.

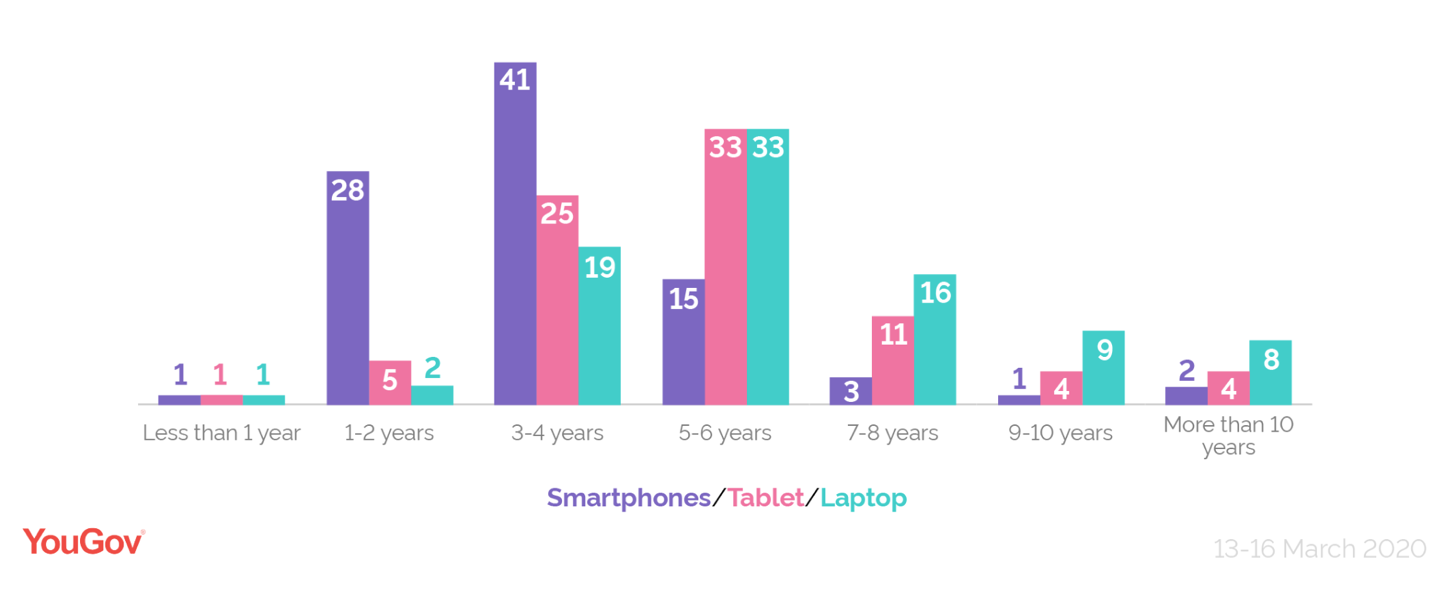

Driving these sales, 28% of respondents to a 2020 UK YouGov survey reported buying a new smartphone every one to two years (Figure 4). Though having reportedly increased in the last five years (Deloitte, 2023), replacement cycles for smartphones are predicted to shorten by 2025 (Businesswire, 2021). For laptops and tablets, the largest share of surveyed owners reported keeping these devices for 5-6 years before purchasing a new one, with approximately three quarters of respondents upgrading to a new device within 8 years. The lifespan of components can be shorter, such as an estimated 4.5-5.5 years for Li-ion batteries in laptops (ICF, 2021).

Figure 4. Length of time respondents report owning smartphones, laptops and tablets before purchasing a new one (%) (YouGov, 2020)

Data collated by the Open Repair Alliance indicates that mobile phones, tablets and laptops are some of the shortest lived products brought to repair cafes. For tablets and mobiles in particular, these are also devices with some of the lowest rates of successful repair (Figure 5).

Figure 5. Rate of success in repairing tablets, mobiles and laptops across repair cafes (Open Repair Alliance, 2022)

Estimating the impacts of product lifespan extension

To explore the potential benefits of extending the lifespan of these three widely used electronics here in the UK, we compared two ‘what if’ scenarios against a business-as-usual case for the 10-year period 2023-32:

-

The first assumes the average lifespans of a smartphone, laptop and tablet coming onto the market from 2023 increases by 20% – equating to an average lifespan of 4 years for smartphones, 6.5 years for laptops and around 5 years for tablets. This is to proxy a more modest increase in lifespans through changes in design and reverse network management affecting only new products;

-

The second scenario assumes average lifespans of these devices increase by a more ambitious 50% (equating in turn to an average lifespan of 5 years for smartphones, 8 years for laptops and around 6.5 years for tablets), and seeks to proxy changes in not only product design but also the use practices of products currently in the domestic stock, including through this extension applying to products coming onto the market from 2021.

Resource impacts

We estimate that extending the average lifespan of smartphones, laptops, and tablets in line with scenario 1, would see the total number thrown away between 2023-32 fall by 10% against baseline (assuming that for each year a person keeps a device for longer this equates to one less purchased), while under scenario 2, this decline is approximately a quarter (24%). This could save between 13,000-27,000 tonnes of materials under scenario 1, while under scenario 2, the savings could rise to between 56,000-75,000 tonnes of material – equivalent to up to 6,000 double-decker buses!

Emissions impacts

We compared emissions associated with production, electricity demand in the use phase and end of life treatment across the scenarios. While under both against-baseline scenarios, per product in-use emissions increase due to the higher average age of products in use with lesser energy efficiency than those which are newer, there is a net- reduction in overall lifecycle emissions of 4% and 10% against baseline due mainly to displaced production emissions.

Economic impacts

Under the two scenarios, consumers and businesses otherwise purchasing these devices could save between an estimated £9.2 billion and £25.2 billion on product replacement across the 2023-32 period. While lifespan extension can be associated with a reduction in intermediate and final demand for manufactured goods assuming no change in prices, this can also be accompanied by an increase in domestic maintenance, resale and repair activities. As these devices are primarily imported rather than produced domestically, the relative impact on domestic manufacturing at present is likely to be more limited.

Barriers and enablers

Barriers to realising the benefits of longer product lifespans exist along the value-chain. Design choices made by manufacturers on product durability or dismantleability, consumer preferences for frequent upgrades and reticence towards second hand purchases and under-developed reverse logistics systems all contribute, as does an underutilised regulatory system.

In a context of these and others barriers economic, regulatory, technological, operational and cultural in nature, several ‘building blocks’ can help think about how to generate greater value in the consumer electronics sector and further afield through more circular practices (Hopkinson, De Angelis and Zils, 2020). These include changes in design by manufacturers, in the business models and reverse network management of retailers and in purchasing and use practices of consumers alongside wider system enablers including government policy and skills.

Product design

One of the biggest challenges to a more circular economy in the UK is that many products and components have not be designed and/or manufactured with longevity, maintenance and repair in mind. Design can be an important enabler of longer product lifespans, tackling material obsolescence through the use of more durable components, supporting disassembly for maintenance and upgrade e.g. by avoiding chemical adhesives and parts and repair information being accessible (European Commission, 2018). For electronics, software support is an important part of continued product functionality, including robust data eradication functionality being in place to facilitate transfer in product ownership.

Figure 6. Repairability scores across smartphone, laptop and tablet models (iFixit, 2023)

iFixit teardowns (2023) shows a wide spread in repairability scores across models of smartphones, laptops and tablets, indicating the potential for improvement across many products in line with what is technically possible.2 At the same time, 48% of tablet, 45% of smartphone and 31% of laptop owners reported that they would buy a new device if the one they used stopped working rather than attempt to have it repaired and citing cost as the primary barrier (YouGov, 2020). For these users, improved repairability can nevertheless help a device be given a second life, while product durability has been highlighted as a means to close the gap between consumer’s willingness to engage with circular economy practices and actual engagement (EC, 2018).

Business models

Though products and their components can often technically be made to be more durable, meeting defined price-points can make the required design and production choices unprofitable (Cordella et al. 2021). With business models as they currently are, a shift from ‘quantity to quality’ is likely to threaten overall sales volumes for many firms (Cooper, 2012), implying new business models will be needed. This might involve making greater margins on products, selling services for product maintainance or increasing ancillary software sales (Deloitte, 2023; EC, 2016).

Innovative business models such as take-back for resale approaches can be premised on and help extend product lifespans (Määttä, 2013). Online sales of second hand and refurbished goods are growing, offering savings to consumers. Ebay and Amazon are just a few of the firms increasingly involved in selling second hand and refurbished electronics goods. A significant quantity of sales of second hand goods also takes place in ‘bricks and mortar’ stores (BEIS, 2021), with mobile phones and computers making up the largest share of sales value for these businesses.

Units: Number of enterprises (number), all other indicators (£ million), current prices

Figure 7. Indicators of circular value retention business activity in the UK economy3

Purchasing and use practice

Changes in purchasing and use practices are also needed to realise the benefits of longer electronic product lifespans. These include more sustainable purchasing choices, product maintenance such as good charging practices, reduced hoarding of unused products and correct end of life treatment.

Though some surveys indicate a frustration among consumers with how long products last (Green Alliance, 2018), the most commonly reason for replacing a smartphone is reportedly ‘wanting the latest phone model’ (Watson et al. 2017 in Bachér et al. 2020). A 2018 survey by the European Commission found 90% of respondents had no experience renting or leasing or buying second hand products, while a substantial share of respondents had not repaired a product in the past (36%).

Furthermore, estimates for the percentage of UK households with at least one unused electronic device put this at at least half (RSC, 2019). Benton et al. (2015) estimate there could be as many as 125 million mobile phone devices ‘hibernating’ in UK homes, while a 2020 survey commissioned by Repic found an estimated 12 million laptops and 9 million tablets unused in UK homes with the potential to be sold or recycled. At product end of life, what people choose to do with devices is highly consequential to their total lifespan, which is the sum of the lifespan of a product with each owner. In a 2017 survey of household waste composition and of 144 thousand tonnes of small e-waste such as laptops, smartphones, toasters and electric hand blenders, 63% were found to have been put into general waste (Wrap, 2020). In a 2020 YouGov poll for Vodafone, around 10% of Brits said they had thrown a phone away in the general waste.

Reverse network management

Many business models and use practices that can help extend the lifespans of products and their components rely on improved reverse logistics systems (Doan et al. 2019). Reverse logistics refers to the process of returning goods from customers to a retail or manufacturing source (Deloitte). Successful reverse logistics systems can help producers retain the value of materials in the economy, including through restocking inventory, the reuse of parts and sale of refurbished items (Intel).

For smartphones, laptops and tablets, many manufacturer and retailer trade-in programmes exist. These incentivise users to return their products via, for instance, credits towards a new purchase and generally with sliding scales based on product age and condition. iris Worldwide estimate that phone users in the UK could be missing out on £6.9Bn in potential savings by not trading in their devices (Vodafone, 2020). Third-party groups such as Envirofone can offer users a financial incentive to do the same. Where these routes are not available, UK extended producer responsibility regulations also require that retailers provide a way for the public to take back products for end of life treatment.

Leakage from established reverse logistics systems can lead to e-waste being treated at the lowest rungs of the waste hierarchy, even aside from general waste. Cole, Gnana and Cooper (2016) found damage in the process of moving waste from end-user to disposal points at household waste recycling centres in the UK limited the reuse potential of items. While suggesting that retailer’s reverse logistics could be better suited to handling goods carefully, improved infrastructure not often yet in place to collect, sort, store and reclaim value from electronics that enter local authority waste management systems, can help retain the value of these products and their materials in the economy and yield local benefits.

System enablers

Increasing product lifetimes is essential if sufficient progress is to be made to a circular, low carbon economy in the foreseeable future. The Government has a vital role to play in promoting the necessary change. Producers and consumers alike need to be encouraged. Governments have a range of policy tools at their disposal (outlined in Longer Lasting Products, p.227), with priorities as follows:

Life-span labels for all electrical and electronic goods should be introduced at the earliest opportunity. These would mostly indicate years, though for some products (such as washing machines) cycles of use would be more appropriate. Such labels would not only enable consumers to make better informed choices but help to raise their expectations of product longevity.

A government serious about environmental sustainability would regard short-lived electrical items as unacceptable as those that are unsafe. It should be mandatory for small household appliances and consumer electronics to be guaranteed to function for a minimum of 5 years. While this may increase costs, longer lasting products offer better value for money in the longer term.

As it is inevitable that some products will develop a fault, repair work needs to be made easier and cheaper. The French Government has introduced repairability labels and several countries have reduced VAT on repair; Britain should do likewise (Cooper, 2023).

Wider system enablers to longer electronic product lifespans include skills for circular value retention activities, data to support consumer purchasing and organisational procurement decisions and government policy. For instance, a lack of skills in repair in the UK has been highlighted by industry (BBC, 2023), alongside ways to address these such as via apprenticeships. While some firms have been proactive in altering product design and business models, government policy is a key system enabler in transitioning to a more circular economy in electronics. Several regulations already in place in the UK applied along the value chain contribute to this value driver and can be potentially leveraged or added to further:

-

- Extended producer responsibility (EPR): The UK-wide Waste Electrical and Electronic Equipment (WEEE) Regulations 2013 place the financial responsibility for end-of-life treatment of e-waste on producers, requiring a certain level of proven treatment in line with product-category-specific collection and recovery targets. Under the regulations, distributors are also required to provide take-back systems for households. While government plans to alter the WEEE Regulations through modulating fees according to criteria of good design could contribute to making the tool a more effective driver of eco-design, it is unclear at this point if the financial incentives this gives alone will be sufficient to drive the design changes needed for longer lifespans of new products (Milios, 2018; Kunz et al. 2014). These alterations likely need to be made alongside others such as increasing the weighting of e-waste sent for reuse in counting towards targets (Resource Futures, 2012; European Commission, 2015) and other tools.

-

- Warranties: A report by the European Parliamentary Research Service suggests the best way to enhance the longevity of products is for a mandatory guarantee equal to a product’s expected lifetime, as defined by technical standards (Keirsbilk et al. 2020). The regulatory basis for this is in place in the UK already. Under the Consumer Rights Act 2015, consumers are entitled to a right to repair or replacement for defective electronics within 6 years of purchase in England and Wales and 5 years in Scotland. At present however, a retailer has the choice of which remedy between these to provide while after 6 months, the burden of proof of a defect being there at the time of purchase lies with consumers. Changes in these two aspects could help strengthen this tool in extending the lifespan of products within scope.4

-

- Ecodesign standards work by limiting entry onto the market of the worst performing products and have a proven track record in driving improvements in energy efficiency across the EU (Schiellerup, 2002). After 2019, the Ecodesign of Energy-Using Products Regulations were extended to require that appliances be longer-lasting in some cases and spare parts be available for up to 10 years alongside repair instructions. Transposed into UK law since, these changes have been referred to as the ‘Right to Repair’ (BEIS, 2021). These do not yet cover small electronics such as laptops, tablets and smartphones (Computer Weekly, 2022), though product prioritisation studies have highlighted their importance (ICF, 2021).

-

- Product labelling follows the logic that by reducing information asymmetries in markets, consumers will be pulled towards greener products and in turn, producers will look to supply these. Exploring adding to existing energy-labels with resource efficiency related data such as expected lifespans should remain a government priority (Defra, 2021). Work is ongoing by the NICER programme’s Interdisciplinary Centre for Circular Metals to explore the most effective design of underlying information for environmental impact and user comprehension (Big Repair Project, 2022).5

-

- Public procurement: Improved public procurement guidance and requirements in line with circular economy criteria can also play a role given the significant demand-side leverage the Government can exert as a larger purchaser. This can provide a direct financial incentive to firms to develop more durable products while also bringing innovation spillovers. Procurement changes can be implemented in a variety of ways, with Sweden for instance, having put in place public procurement requirements for refurbished ICT equipment across its municipalities (Crawford et al. 2018).

-

- Price-based instruments: A variety of proposals have been applied and put forward to better leverage price-based instruments for circular economy aims. Taxation on non-recycled content and reduced VAT, altered business rates and National Insurance contributions for activities such as maintenance and repair are examples. Enhanced Capital Allowances (ECAs) have also been identified as a suitable measure for extending the lifespan of laptops (ERM, 2011). The effectiveness of approaches such as reduced VAT will depend on their ability to alter the economics of purchasing and use choices, including alongside other measures.

As part of its work in accelerating the shift towards a more circular economy, the NICER programme is reviewing and building evidence regarding the effectiveness, design and implementation of options available to policy makers and other actors in the regulatory landscape to drive circular value creation.

Click here to read more about our Methods, Data and Assumptions

To estimate the benefits of extending the lifespan of smartphones, laptops and tablets in the UK, we developed a stock-flow model covering the years 2008-2032. Additions to the stock in units of products was calculated on an apparent basis as domestic production + imports – exports, using public data on domestic production from the ONS’ UK Prodcom survey and trade data published by HMRC via the UKTradeInfo site. The prodcom code ‘263022’ (telephones for cellular networks and for other wireless networks) and trade HS/CN6 code ‘851713’ were used to represent smartphones, while the prodcom code ‘262011’ (Laptop PCs, Notebooks and palm-top organisers) and HS/CN6 code ‘847130’ (Data-processing machines, automatic, portable, weighing \<= 10 kg) were used to extract data on laptops and tablets. The percentage of these codes’ flows estimated to be the products of interest were estimated based on a combination of product penetration surveys and shipment data. A naive forecast approach was used to estimate baseline inflows 2023-32. Product unit flows were translated into apparent material equivalents using average, upper and lower product material composition figures from Babbit et al. (2020).

Scenario analysis involved simulating an extension in the average lifespan of products in scope through increasing the scale parameter of the Weibull function. Baseline product lifespan distribution assumptions were built through triangulation, using the Weibull shape parameters supplied by Forte et al. (2018) and altering the scale parameters to better reflect the UK context. Impacts on units and material flows, lifecycle emissions and consumer savings were used as the basis for comparing scenarios. Outflows were calculated as the sum of products entering the stock in each historic year multiplied by a survival function based on these parameters. Share across disposal routes were based on Sayers and Peagham (2020), with the breakdown of landfilling vs. incineration based on England local authority waste management statistics (Defra, 2022). Emissions factors for production, use and end of life emissions were taken from the UK government conversion factors (BEIS, 2022). Transport emissions were not considered. Material or energy inputs required to enable lifespan extension were not calculated, but those associated with potentially offset production were. Consumer savings were estimated based on assumed sales prices multiplied by displaced unit sales.

Footnotes

- For instance, a 2017 study by UNEP showed that while prolonging the use of laptops, tablets and mobile phones is frequently preferable to upgrading to more energy efficient products from a carbon reduction perspective, given improvements in energy efficiency and based on levels of product use, ‘optimal replacement moments’ can be calculated. These were estimated to be 7 years for laptops.

- Please note that where iFixit have reviewed multiple products released by a brand in the same year, we have taken an average of provided scores.

- Activities such as remanufacturing are not separately classified, while firms providing services in scope but without this being their primary activity are omitted due to data reporting conventions (CE-Hub, 2022).

- Where these obligations are not applicable, limited competition in extended product warranty markets has been tackled in the past via the Supply of Extended Warranties on Domestic Electrical Goods Order 2005 legislation.

- Separately, The Restart Project have recommended that legislation proposed by the Department for Digital, Culture, Media & Sport for manufacturers to state, at point of sale, how long the device will receive security updates (2021) should be extended to cover all internet-connected devices.

**

If you’d like to discuss the ‘Extending Product Lifespans’ series further or find out about current projects and forthcoming outputs from the CE-Hub, please contact us at ce_hub@exeter.ac.uk.

Lead author: Oliver Lysaght.

With contributions from Peter Hopkinson, Markus Zils, Esmaeil Khedmati Morasae and Ryan Nolan.